GOLDEN WEST FINANCIAL CORPORATION

|

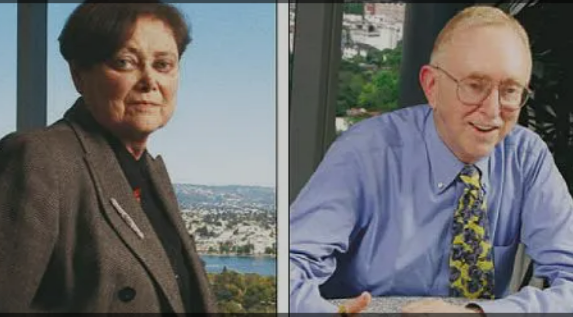

HERBERT AND MARION SANDLER

Introduction |

Stock analyst Marion Osher and New

York Attorney Herb Sandler met on a beach in the Hamptons in 1960, married in

1961.In 1963 they bought Golden West a small California

savings and loan company. They proceeded to grow that company into an industry

giant that was widely admired for its outstanding profitability, its

operational excellence and its exemplary corporate culture.The retired when Golden West was acquired

by Wachovia Corporation on October 1, 2006.

The Founders' Background

At the time they met in 1960 Marion Osher

was a stock analyst working at an Oppenheimer and Company office in New York.

Herb Sandler was an attorney working for a small law firm in New York.

Marion grew up in an affluent family which encouraged her to

believe that she could do anything she wanted to do as an adult. She did her

part, graduating Phi Beta Kappa from Wellesly and

then completing a one-year business program offered jointly by Harvard and

Radcliffe. After training at Bloomingdale's she sought

and found a job as a stock analyst at Oppenheimer. But she quickly found out

that there was no possibility of her becoming a partner at Oppenheimer because

she was a woman. Consequently, while analyzing the savings and loan industry

for Oppenheimer she also began thinking about starting her own business.

Herb grew up in New York, earned a law degree from Colombia

University and joined a small local law firm. Among his clients were several

who had investments in California savings and loan firms.

After their marriage Marion's concerns became Herb's concerns; her business dream became his dream. Marion's work opened her

eyes to the possibility of buying a small savings and loan company. As she once

explained (Golden West Financial, Jan. 18, 2004):

"I was working on Wall Street as a financial analyst.

At that time, there were one or two publicly held savings and loans. Then they

all started to go public. I looked at these companies and they were all in California. Herb

and I became intrigued by the industry. Herb was practicing law and he had some

clients who had savings and loans out there. We decided we would visit

California, we would buy a savings and loan, we'd build it up and go public... we moved to the Bay Area and started knocking on

doors."

Herb and Marion's search led them to Golden West Savings,

headquartered in Oakland with a branch in Castro Valley. It had $34 million in assets and 25

employees; was profitable; and did not appear to have any serious problems that

the new owners would have to resolve. The Sandlers

bought Golden West for $3.8 million. They, themselves, provided $600,000 in

equity and Marion's brother Bernard Osher helped with

an equity investment of his own. Forty years later Golden West would have $80

billion in assets and the Sandlers' equity in the

company would be worth $1.8 billion (Lubove,).

The Founders' Basic Business Model

Herb and Marion bought a small business, so small that they

personally participated in performing every job in the company. But the

founders had a clear plan to grow the business. And the business model they

adopted from the very beginning was essentially the business model they were

using at the time Golden West was acquired by Wachovia in 2006. The 2004 annual

report described that model as follows (Golden West Financial Corporation,

2004):

"We are a residential mortgage portfolio lender. In

order to increase

net earnings under this business model we focus principally

on:

growing net interest income, which is the difference between

the interest and dividends earned on loans and other investments and the

interest paid on customer deposits and borrowings:

maintaining a healthy primary spread, which is the

difference between the yield on interest-earning assets and the cost of

deposits and borrowings:

expanding the adjustable rate mortgage (ARM) portfolio,

which is our primary earning asset:

managing interest rate risk, principally by organizing and and retaining monthly adjusting ARMs in the portfolio, and

matching those ARMs with liabilities that respond in a similar manner to

changes in interest rates;

managing credit risk, principally by originating

high-quality loans to minimize nonperforming assets and troubled debt

restructuring;

maintaining a strong capital position to support growth and and provide operating flexibility;

controlling

expenses; and

managing

operations risk through strong internal controls

This was a sensible, conservative model, but one which

diverged markedly from the common practice in this industry. The common

practice was to offer long term fixed rate mortgage loans using shorter terms

deposits as the source of funds. This could be a recipe for disaster if the short term rates needed to attract deposits rose above the

long term rates being paid on the loans. And, indeed, in the 1980s, the savings

and loan industry suffered cataclysmic losses because of this original practice

(plus some short-cited political patches applied by the U.S. Congress).

Hundreds of savings and loans had gone out of business by the 1990s. Of the twenty largest

savings and loans in 1989, only Golden West was still in existence a decade

later (Golden West Financial Corp., 2004).

Additional Elements of the Plan

The Sandlers' business plan also

included a clear vision of the kind of company culture that was to be created.

It was to be a competitive, growth oriented culture.

The Sandlers would set high targets for growth of

earnings per share.

It was to be an environment where employees came to stay and

were able to satisfy their needs. It was to be a place where were initiative

was expected and merit rewarded. There would be no place for office politics

and inefficient bureaucracy. As Herb put it, "The companies we'd worked

for had been highly bureaucratic, organizations where you couldn't get anything

done. And they were all political. Our first promise was that we'd never be

bureaucratic or political.(Jennings,p.102).

Employees would have a continuous improvement mentality. It

was to be a place where waste was constantly identified and eliminated. Waste

was defined to include unnecessary activities. The question everyone was

expected to ask was, "What's the good business reason for doing it."

That applied to technology, too. Herb and Marion were keenly aware of the

danger of adopting new technology because it was fashionable even though there

would be no real productivity gain. As Herb put it, "More money than you

can imagine has been wasted down a technology rat-hole by companies playing a

game of 'keep up with the Joneses'" (Jennings, p.177).

Among the practices designed to instill the corporate

culture among employees were the following three in order of magnitude:

Selection

and retention

The Sandlers recognize that their

corporate culture is not a good fit for everyone. So

they screen new hires carefully. But once a good fit is hired, they make every

effort to keep them for the long term. As Herb said, "Once people become

part of our family - our culture - they don't leave the past twenty five years we've only lost three

executive team members we would have liked to keep." But there is a

weeding out process in the beginning. As Herb again says, "We're

competitive. We want to win. There's no place for anyone to goldbrick."

(Jennings, pp.161-162).

Further commenting on retention policy, Marion says,

"People have to have job satisfaction. You can't pay people enough to work

in a place they don't enjoy and where they aren't surrounded by other people

who share the same kinds of view." And Herb adds, "You can't build a

great company with high turnover. Our goals are very long term and we look for

people who share that value and then compensate them so their long term objectives are satisfied as well as the

company's" (Jennings, p.163).

Committee for handling items not covered in approved budgets

"When unforeseen circumstances cause a manager to request addition funds

beyond the year's approved budget, a budge committee

is convened to decide the issue. In most companies the decision-making group

would consist of top officers. Not at Golden West. Instead the company,

"uses membership on the committee as a way of quickly indoctrinating staff

and executives into the World Savings culture. Membership on the

committee is rotated so that the enculturation process is spread widely.

(Jennings, p. 130).

Practice

of one of the Sandlers calling each employee on the

occasion of an important anniversary

From the outset the Sandlers included a social mission in

their plan - eliminating discrimination against women. In particular, it would

be a pioneer in giving women equal opportunity. But the emphasis had to be on

opportunity. Women employees would be judged on merit just as were all male

employees.

For Herb and Marion it was to be an

equal partnership. They would work side-by-side. They would hold the title of

co-chief executive officer. In the beginning they would do everything together.

Then as they got larger they would begin to divide the chores. Eventually

Marion became more active in the day-to-day management while Herb spent more

time on the loan side (Golden West Corporation, Jan. 18,2004).

For both Sandlers Golden West was

to be a place that would add meaning to their lives both in terms of individual

achievement and in terms of serving some larger purpose. Decades later Marion

captured this objective with the following answer to the question, "What

do you like most about the business" (Jennings, p.220):

"From a gratification point of view we're in a wonderful business. We

don't pollute, we enable home ownership to people, many of them minorities, we

ethically safeguard people's money. But the other thing that gives us real

satisfaction is being highly competitive and outplaying and outwinning

the competition."

Executing the Plan

For 43 years the Sandlers operated

with basically the same business model and business plan. During that time the

economic environment changed dramatically. There were two major recessions and

one prolonged period of high inflation and high interest rates. There was a

period of interest rates so low that there was a question of whether or not

adjustable rate mortgages could be sold. But the model anticipated these ups

and downs of the economy and Golden

West's employees, including the Sandlers, were able

to execute the model at a high level of performance.

Growth performance

was outstanding. By the time of the 2004 annual report the company was able to

report that:

Year end

(2004) assets were $ 106.9 billion ($106,888.541,000)

The

company operated 506 offices in 38 states

Earnings

before taxes were $ 2.7 billion ($2,069,001,000)

Profit performance was even more outstanding. The 2004

annual report claimed , "a long-term earnings

record that has outperformed most of the country's leading corporations for 35

years, through all phases of the business cycle" (p.5). For that entire

period the annual rate of growth of earnings per share was 19 percent. For

shorter periods over the same 35 year period the

numbers were: 23% for last 5 years; 21% for last 10 years, 17% for last 15

years; 16% for last 20 years, 17% for last 25 years (p. 5).

As hoped, Golden West became the major vehicle whereby Herb

and Marion found fulfillment and happiness in their lives. They did have a life

outside of the business. They raised two children, a boy and a girl, both of

whom became involved with the Sandlers' charitable

work as adults. They became active supporters of several charitable causes which appealed to their liberal democratic values. But the

business consumed the bulk of their time and attention. As Marion's brother,

Bernard Osher, put it in 2004, "Their business

is seven days, seven nights a week. They watch the store. That's their life"

(Lubove).

Also as hoped, Golden West became a

leader in giving women an equal opportunity in business. As Marion once put it

(Jennings, p.103):

"We were the first company with women loan

representatives, loan salespeople, appraisers,and

branch managers... The other thing we didn't do was go out

and hire figurehead branch managers. We simply didn't do it. We were committed, and are, to promoting from within and

because most of the tellers were women, they became the universe from which we

promoted."

Giving opportunities to women didn't stop with employment.

By 2002 Golden West's board of directors had more women than men (Jennings,

p.103).

There was continuous change as planned, but almost always

within the framework of avoiding waste. For example, when the company began to

open new branches, it realized that most financial institutions

built branches that were too large. Here is how Marion described the Sandlers' thinking (Jennings, p. 104):

"At the time, most financial institutions were building

branches of ten thousand to fifteen thousand square feet, but a little

industrial engineering makes you wonder why you need all that space. The

purpose of a branch is to collect deposits from people. Why would you need

fifteen thousand square feet to do that?" " It wasn't only the cost

savings realized with a smaller branch but what was going on inside these big

vast spaces. There was always a male branch manager sitting on a pedestal whose

job was to glad-hand people, while the real work was being done by a woman, the

head teller/operations officer. We eliminated the position of male branch

manager right away. They didn't do anything."

Another interesting example of the elimination of waste at

Golden West was the elimination of a receptionist at the home office. There was

a receptionist's desk to great each visitor. But on the desk was a telephone

with instructions on how to call the person you wanted to see.

Continuous improvement took also took the form of periodic

adjustments of the basic business model. Among the examples were:

The

decision to hire the firm's own appraisers. The Sandlers

decided that, "the fee-based appraisers used by most financial

institutions will deliver the appraisal required to get the loan done and not

necessarily deliver an appraisal that reflects the property's true

worth." The justify the extra expense

on the grounds that it increases the likelihood that if the borrower defaults

the company can quickly sell the property at full price (Jennings, pp.108,

220).

The

decision to develop the firm's own benchmark for adjusting the adjustable rate mortagages. The Sandlers decided

that the common

Indexes

used by their competitors were finely tuned to the actual changes in cost

funds.

The

decisions to offer a small percentage of fixed rate loans

The

decision to raise funds for mortgage loans by borrowing from the FHLB

The attention paid to waste and continuous improvement

showed up in Golden

West's financial performance. The company became one of the

lowest cost operators in the industry. In 2004, for example, Golden West's

expenses were less than one percent of assets compared with a savings and loan

industry average of 2.3 times that (Lubove)

There was one potential indulgence - Marion hired name

architects.

Successor Management

As late as 2004 Herb and Marion planned for an orderly

succession when they retired. As Herb and Marion put it in January of that year

(sfgate, p.5)"

Marion - "We are very much a team operation. There's no

way that a company with $80 billion in assets can be run by two people. The

reality is, however, that we are husband and wife-I'm a woman CEO-so we get a

lot of attention. This company has a strong management team, and we've done

succession planning for 20 years. "Herb - "Twice a year, we play the

'Mack truck' game. The senior executives get together and each of us has to

say, 'What happens if we get knocked off?' Marion and I travel together so we

have to talk about what would happen if we got knocked off. And then what

happens if Jim Judd or Russ Kettell - the next two

people-get knocked off? They have to plan who their successor is."

Herb and Marion were open to the idea that the company would

remain independent. And they planned to put their stock holdings into a

foundation which could vote to maintain independence. But they only owned 10

percent of the common stock so the ultimate question of independence was beyond

their control.

It did not take long for the question of independence to be answere. In October of 2006 Golden West was acquired by

Wachovia Corporation. Succession was still an issue, of course, but the

ultimate responsibility moved up to the new parent organization. One thing was

certain, the Sandlers had left the company with a

seasoned corps of executives prepared to take over if that were to be the wish

of Wachovia.

The Charitable Remainder of the Story

Herb and Marion Sandler's success at Golden West made them

extremely wealthy Americans. That fact caused them to analyze their options

with respect to the disposition of their wealth. And they concluded that

everything they made would be given away. They identified five areas which they

would target for their charitable giving - international human rights, early

childhood education, the environment, medical research and advocacy. Within

those areas they adopted a strategy of looking for areas where they could make

a difference. (sfgate, p.8)

The Sandlers brought both of their

children into their charitable activities. Their son ran the environmental

program for them. And their daughter was involved in the educational area.

(Golden West Financial Corp., Jan 18,2004, p.8).

Conclusion

Herb and Marion Sandler achieved outstanding financial

success in business by means of a strategy well suited to their chosen industry

and through outstanding execution of their business model. They were flexible;

they were committed to continuous improvement as a practice; and the instituted

numerous changes during their 43 years of business success. But they had the

wisdom to stick with their basic business model because it worked.

But making money was not the Sandlers'

goal. They deliberately chose business as the primary means of living

meaningful lives and achieving a successful marriage.

In 2006 the 1992 MIT Professor

of the Year", Dr. Fred Kofman, published a

management book that might be a good description of the Sandlers'

approach to business. In his words (p. 279):

"The larger purpose of business-or sports, or any

competitive activity, for that matter - is not to succeed, but to serve as a

theater for self-knowledge, self-actualization and self-transcendance.

We discover who we are and what we really stand for when we respond to

(business) situations. We establish our values through our behavior and our

dealings with other people and the world. We transcend ourselves as we expand

our circle of care and concern to include colleagues, customers and others. Of

course, in order to keep the business game alive, players must strive to make

money and accomplish their mission, but the game is about much more than

winning. Material success is not the end anymore; it becomes a means to

developing and expressing our highest nature."

References

"Challenge Grant Will Bolster Human Rights Cause,"

Human Rights News, http://hrw.org/english/docs/2004/12/16/global9900.htm

Golden West Financial Corporation. 2004 Annual report

"Golden West Financial Corp, On the record: Marion and

Herb Sandler," SFGate, January 18,2004

(www.sfgate.com).

Jennings, Jason. Less is More: How Great Companies Improve

Productivity without Layoffs. New York: Penguin Group, 2002.

Kofman, Fred. Conscious Business.

Boulder, Colorado: Sounds True, 2006.

Lubove, Seth, "Stick to Your

Knitting," Forbes Online, March 1, 2004 (www.forbes.com)

"Marion Sandler," USBANKER, October,2005 (www.us-banker.com)

ANBHF Laureates

Our laureates and fellows exemplify the American tradition of business leadership. The ANBHF has published the biographies of our laureates and fellows.

Some are currently available online and more are added each month.