Swift & Company

Click for PDF version of Gustavus Franklin Swift -- Swift & Company

-- Biography

Click for Gustavus Franklin Swift Wikipedia Page

Introduction

Gustavus Franklin Swift

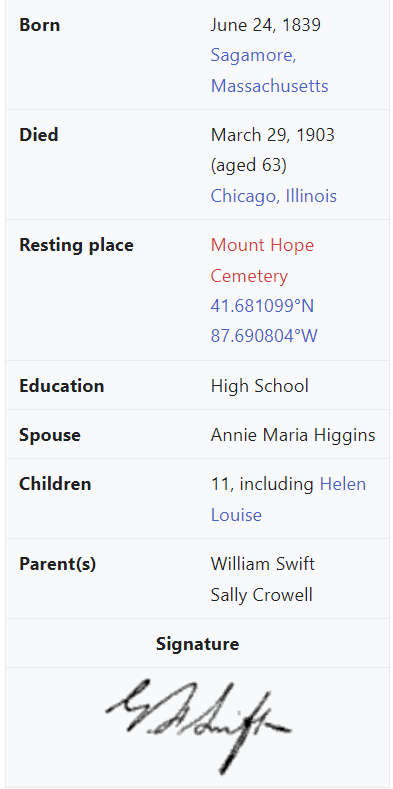

Gustavus Franklin Swift Life Stats -- Swift & Company

Gustavus Franklin Swift Life Stats -- Swift & Company

Gustavus Franklin Swift was born on June 24, 1839, in Sagamore, Massachusetts. Gus was one of 12 children and began work at age 14 for an older brother "who was a local butcher" (p. 47). At 16 Gus thought of moving to Boston but his father convinced him to stay in Cape Cod by offering "Gus $20 to stay and start in the meat business at home" (p. 47).

Gus used the $20 to purchase a heifer, and then he butchered and sold it out of his father's wagon. A few months later he expanded his meat business by borrowing $400 from an uncle. After working for a year, Gus opened his first retail meat market. He then opened two more retail stores in the area. Next Gus became a cattle buyer. "Working 16 hours a day and exhibiting great skill in judging the market value of the cattle he was buying, Swift made his new venture a huge success" (p. 48).

In 1869 Swift opened a meat market in Clinton, Massachusetts. Unlike most markets, he displayed "many cuts of meat, giving the most prominent spots to those cuts which customers were less likely to request. The Clinton market was highly successful and was soon doing an annual volume of $35,000 to $40,000" (p. 49).

Swift then became a wholesaler of cattle and formed partnerships with two men to buy cattle for them. "Swift's attention began to be focused on the chain of supply that brought the live animals" (p. 50) to Massachusetts. He found that Chicago was the best place to buy cattle. "It was the place where the greatest selection was to be found and it would allow him to cut out the middleman and thus reduce handling costs" (p. 50). Swift also recognized that if he slaughtered cattle in Chicago and then shipped them; he would save on freight and feeding charges. Although he "was short of capital" (p. 52), Swift found a company that would build the refrigerated railroad cars he needed, and got the company to agree "to let him pay 15 percent down and repay the balance out of earnings" (p. 52).

Swift soon found that the markets in Massachusetts refused to buy his meat. When he lost $500 on a car full of meat, "he bought a lot, obtained a switch track, and had lumber delivered to the site. Next day, a branch-house market was being erected" (p. 54). Before this market opened, one of the local dealers who had refused to buy Swift's meat asked if he could become a local agent for Swift. "'We lost five hundred dollars on a car of beef because of your boycott,' he was told. 'If you assume that loss, I'll be glad to have you as my partner in this market.' The deal was closed right then" (p. 54).

With his fundamental idea a proven success, Swift entered into a period of almost "frantic growth" (p. 54). Swift put most of his profits back into his business. But "Swift's demand for capital to finance his expansion was insatiable" (p. 55). He stretched "his borrowing to such limits as to create great risk of a liquidity crisis" (p. 55). "Practically every department head of the company had lent the company his lifetime savings on a note endorsed by G.F. Swift. Many of the subordinate employees had lent their money, too. . . The men knew their chief needed cash, so they brought him what they could" (p. 57).

In 1893 when "the ticker tape from the Chicago Board of Trade carried the message that Swift & Company had failed" (p. 61), Gus Swift was on the floor within half an hour. After gaining complete silence he said "'It is reported that Swift & Company has failed. Swift & Company has not failed. Swift & Company cannot fail!' He walked out in a dead silence which held for thirty seconds after he was gone" (p. 61).

Once a group of bankers met "to consider just what steps should be taken to put an end to all this uncertainty and to plan concerted demands at once so heavy he could not possibly meet them" (p. 61). Swift walked right into the meeting and stated, "You gentlemen think you might be better off by bringing financial pressure to bear on us. I'm sorry, gentlemen, but we have to have more money, not less. It is up to you to lend it to us. If we don't get it, we go down-and a good many of you go down with us. Before he left the meeting, he had increased his line of credit-and on terms which permitted no future harassment" (p. 62). "After the Panic of 1893, Swift & Company entered a new era of financial stability" (p. 63).

One method utilized by Swift to motivate employees to focus on the company's profit goals was to promote from within. He devoted a great deal of time to identifying employees and teaching them his methods and policies. He was a demanding teacher. He believed that if a thing was worth doing it was worth doing right, and mistakes quickly evoked his wrath. But he managed to train a highly effective group of managers who continued to run the company well for decades after Swift's death. Gus Swift died on March 29, 1903, in Chicago.

This article was written by Dr. Richard Hattwick.

*Copyright 2002. The American National Business Hall of Fame. All rights reserved. No portion of ANBHF may be duplicated, redistributed or manipulated without the expressed permission of the ANBHF.

Copyright 2001 American National Business Hall of Fame. All Rights Reserved.

American National Business Hall of Fame - Contact

c/o Western Illinois University Libraries WIU Libraries

Macomb, IL 61455

(309)298-2705